A number of gold charts have caught my eye in recent days/weeks, so I thought it could be a good idea to collate them here. It’s a departure from the usual focus on the S&P500 with the weekend weekly chart-tweet-storms, but I figure let’s give this a try and see if there is interest in the occasional “off-topic ChartStorm“…

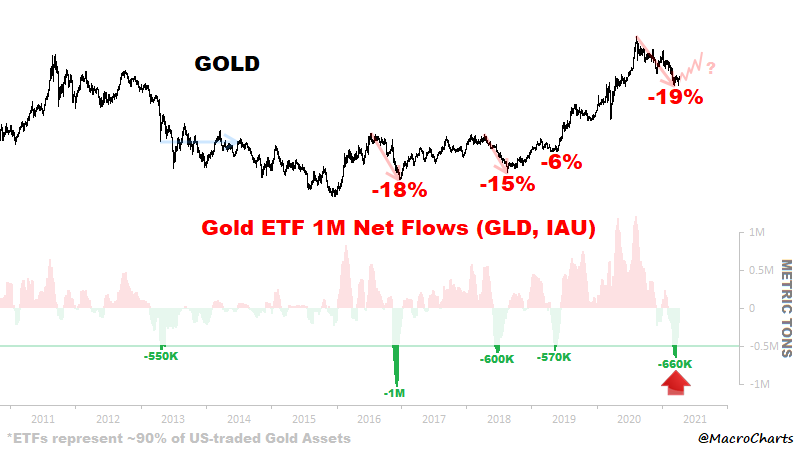

1. Gold ETF Flows - Capitulation Mode: Previous episodes of gold ETF flow capitulation were followed by rallies in the gold price (albeit note the exception during the 2013-15 gold bear market).

Source: @MacroCharts

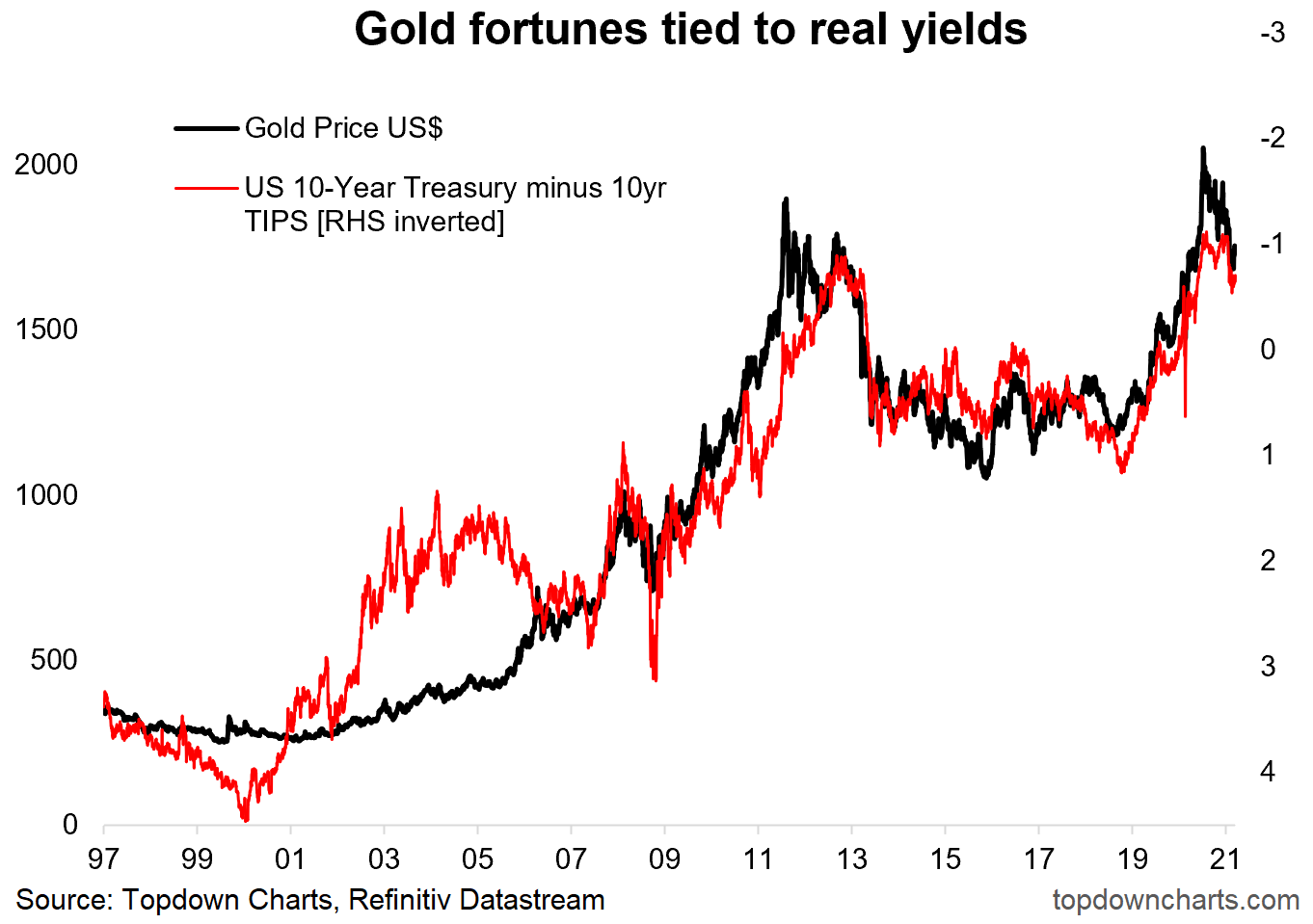

2. Rising Real Yields a Real Problem for Gold: Fairly clear and economically logical link here, but note that real yields are pulling back from resistance (n.b. real yields are inverted in this chart). Know real yields: know the gold price…

Source: @topdowncharts

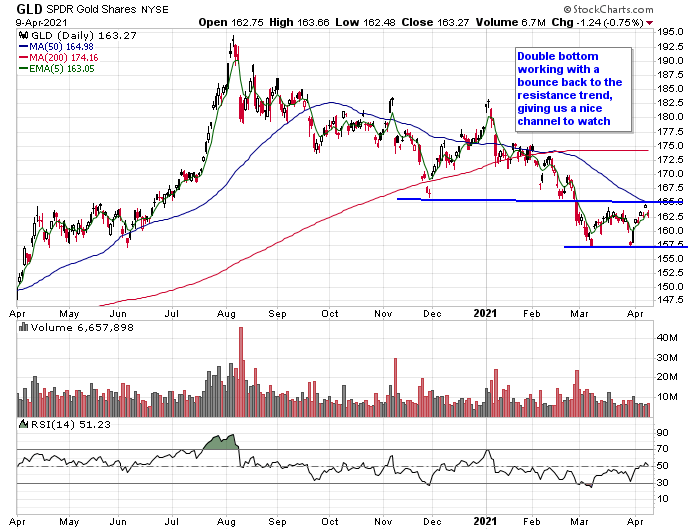

3. Double Bottom? Twice the fun - certainly looks interesting, and at the very least gives us a level to work with in terms of downside triggers.

Source: @kkernttb

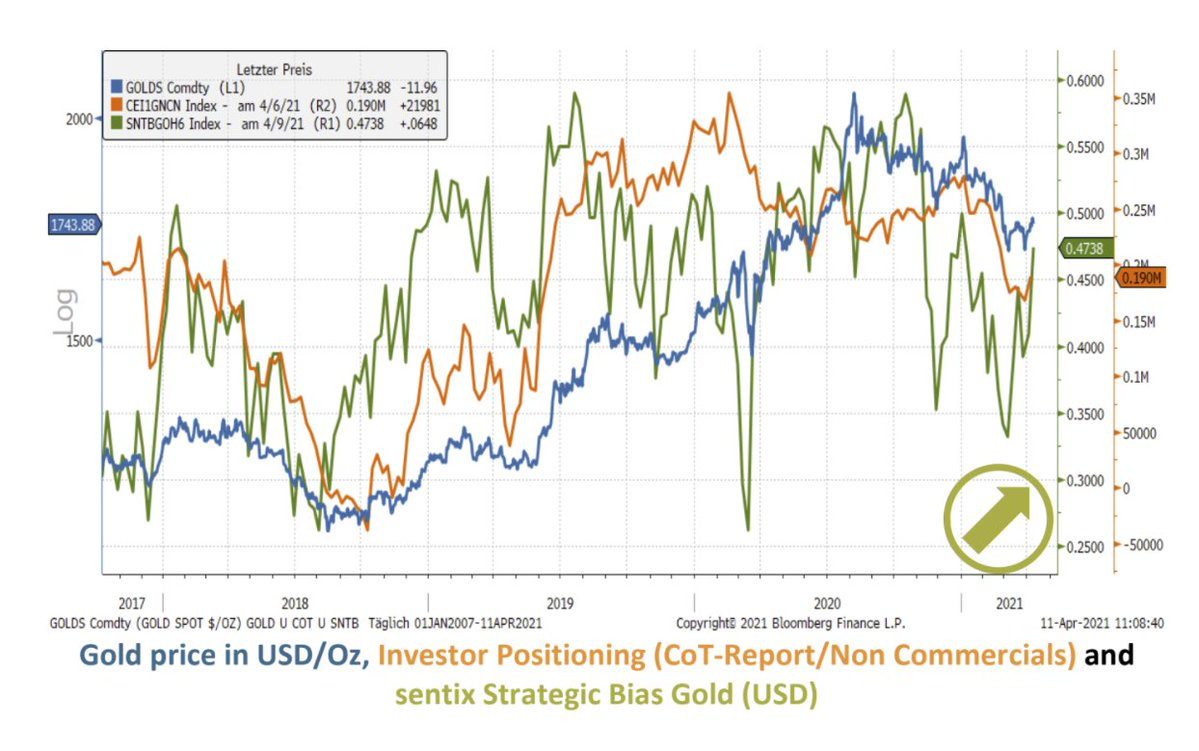

4. Gold Sentiment Turning up following Reset: The Sentix survey “Strategic Bias“ indicator for gold has started to trend upwards following a fairly decent reset. Lines up with the conclusion in the ETF flows chart.

Source: @sentixsurvey

5. Gold FX Breadth Indicator: One of my own creations, this tracks a composite breadth signal from the price of gold in 8 different currencies. After collapsing to fairly washed out levels, it has turned up.

Source: @topdowncharts

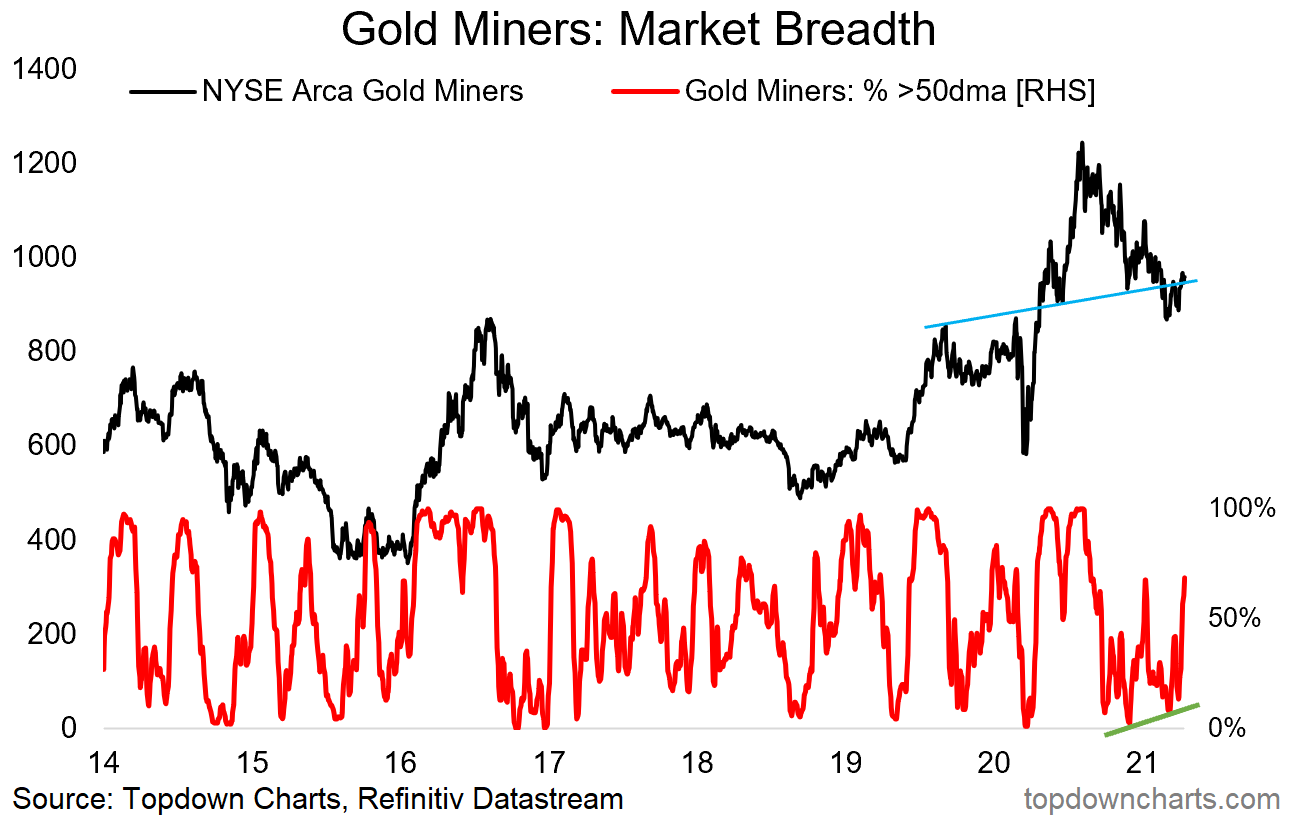

6. Gold Miner Market Breadth - Bullish Divergence: Interestingly in this chart we’ve seen both a bullish divergence (lower low in price vs higher low in the breadth indicator AND a failed head & shoulders top. Looks promising.

Source: (Topdown Charts Global Cross Asset Market Monitor)

7. Gold Miner Technicals Part 2: Gold miners have come back after a foray with a fairly important zone of support: but down-trending resistance looms overhead. Also of note is the RSI seems to be breaking out…

Source: @murphycharts

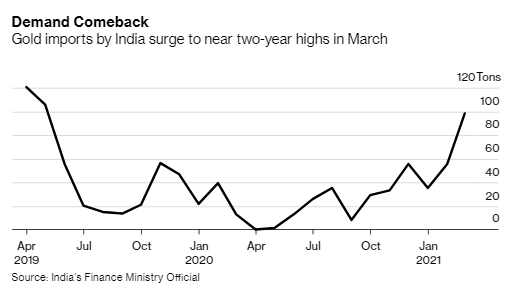

8. Indian Gold Demand Heating up: While investors seem to be shunning gold ETFs, gold imports by India have surged in recent months - a bit of bargain hunting?

Source: @markets

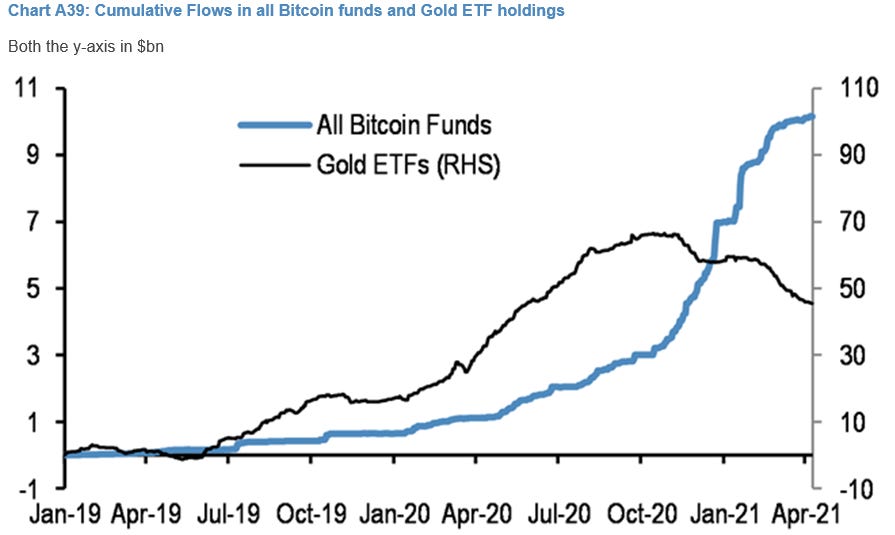

9. Old Coin vs New Coin: **Note the dual axis, but also note the surging interest in “New Coin“ (i.e. Bitcoin funds - and crypto in general) vs waning interest in “Old Coin“ (all gold ETFs). There is this argument that crypto is ‘stealing‘ demand from precious metals - personally I don’t buy that at all because the demand drivers/fundamentals are extremely different for the two assets. A simpler explanation is probably just what’s been going on in the price action.

Source: @MacroCrude

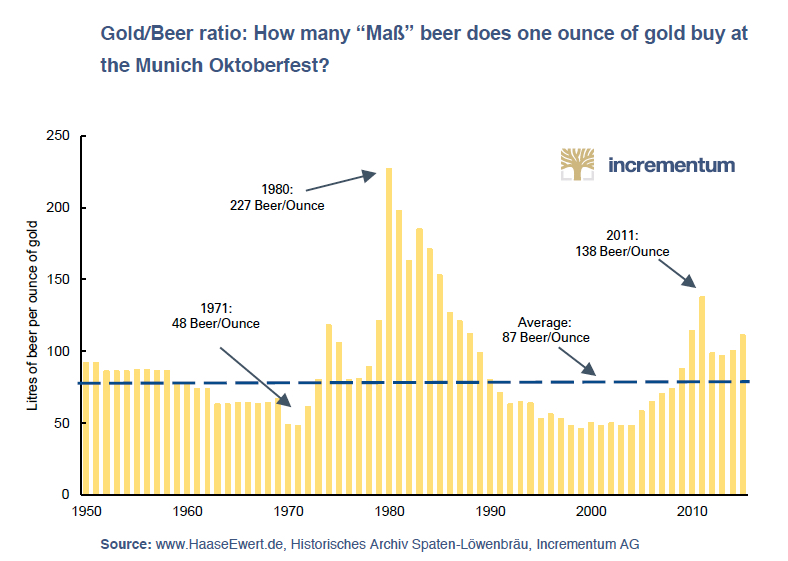

10. Gold vs Beer: Personally I would prefer the more liquid option here! On a personal note, I actually went to Oktoberfest for my first time in 2019, it was awesome - everything I hoped for and more. Looking forward to returning again some day in the future…

Source: @RonStoeferle

Thanks for tuning in - be sure to subscribe (free) if you haven’t already, and please share this with anyone you think might be interested.

cheers,

Callum